Some Of Simply Solar Illinois

Some Of Simply Solar Illinois

Blog Article

Simply Solar Illinois Things To Know Before You Buy

Table of ContentsThe Definitive Guide to Simply Solar IllinoisLittle Known Facts About Simply Solar Illinois.7 Simple Techniques For Simply Solar IllinoisThe Basic Principles Of Simply Solar Illinois Some Ideas on Simply Solar Illinois You Need To Know

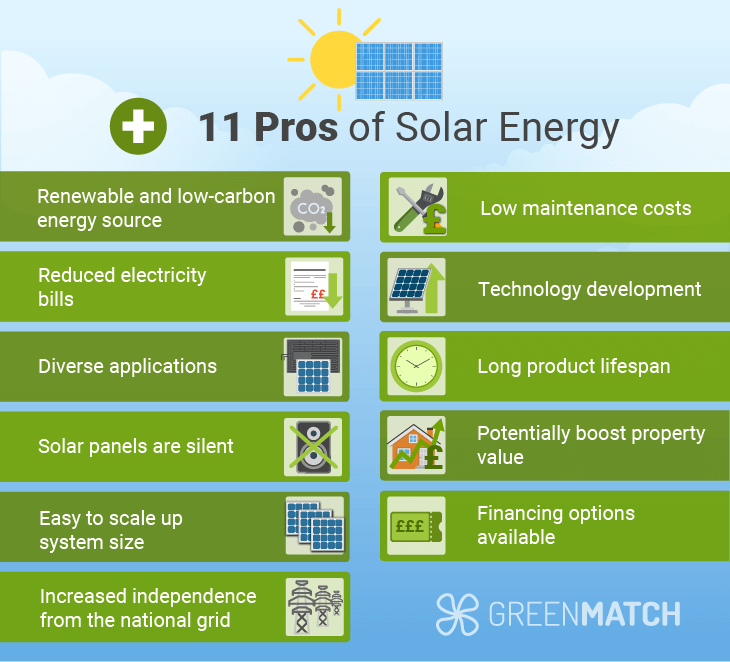

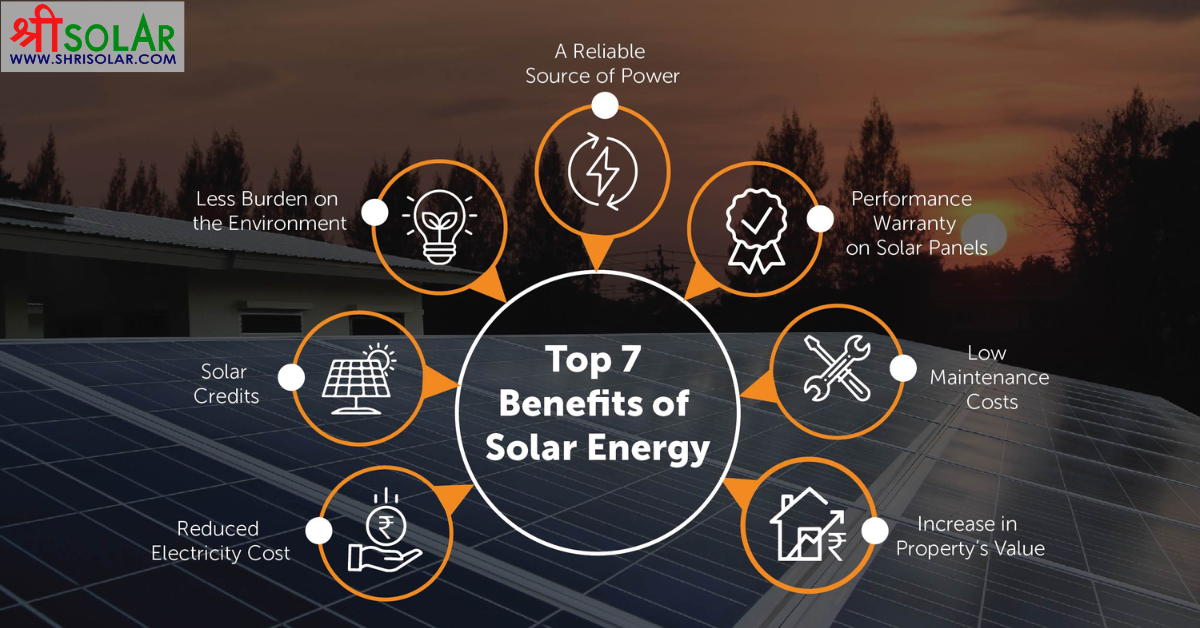

Our team partners with neighborhood neighborhoods throughout the Northeast and beyond to deliver clean, affordable and trusted power to foster healthy areas and keep the lights on. A solar or storage space project delivers a variety of advantages to the community it serves. As modern technology breakthroughs and the expense of solar and storage space decrease, the economic advantages of going solar continue to climb.Assistance for pollinator-friendly habitat Habitat repair on infected sites like brownfields and garbage dumps Much needed shade for animals like lamb and fowl "Land financial" for future agricultural usage and dirt quality improvements Because of climate adjustment, extreme weather condition is ending up being much more frequent and turbulent. Therefore, property owners, services, areas, and energies are all becoming more and more thinking about safeguarding power supply remedies that supply resiliency and power safety.

Environmental sustainability is one more vital chauffeur for businesses buying solar power. Several companies have robust sustainability goals that include lowering greenhouse gas emissions and utilizing much less sources to help reduce their influence on the natural surroundings. There is an expanding urgency to deal with environment adjustment and the stress from consumers, is arriving levels of organizations.

8 Simple Techniques For Simply Solar Illinois

As we come close to 2025, the assimilation of photovoltaic panels in industrial tasks is no longer just an alternative yet a critical necessity. This blogpost looks into how solar energy jobs and the diverse benefits it offers industrial buildings. Photovoltaic panel have actually been used on residential structures for numerous years, however it's only lately that they're ending up being much more usual in industrial building and construction.

In this post we review how solar panels job and the advantages of making use of solar power in industrial structures. Electrical power prices in the U.S. are boosting, making it extra expensive for services to operate and much more difficult to intend in advance.

The U - Simply Solar Illinois.S. Energy Details Management expects electric generation from solar to be the leading resource of development in the U.S. power sector through completion of 2025, with 79 GW of new solar capacity predicted to come online over the following 2 years. In the EIA's Short-Term Power Expectation, the company claimed it expects sustainable energy's general share of electrical energy generation to climb to 26% by the end of 2025

The Single Strategy To Use For Simply Solar Illinois

The sunshine triggers the silicon cell electrons to propel, producing an electric current. The photovoltaic or pv solar cell soaks up solar radiation. When the silicon connects with the sunlight rays, the electrons start to relocate and develop a circulation of straight electrical present (DC). The wires feed this DC electrical energy into the solar inverter and convert it to rotating power (AIR CONDITIONER).

There are numerous means to store solar power: When solar power is fed right into an electrochemical battery, the chain reaction on the battery parts maintains the solar power. In a reverse response, the present exits from the battery storage space for usage. Thermal storage uses tools such as molten salt or water find this to retain and soak up the warm from the sunlight.

Solar panels significantly reduce power prices. While the preliminary investment can be high, overtime the cost of installing solar panels is redeemed by the cash saved on electrical energy expenses.

A Biased View of Simply Solar Illinois

By installing solar panels, a brand shows that it appreciates the environment and is making an initiative to reduce its carbon footprint. Buildings that rely entirely on electric grids are at risk to power failures that occur during bad weather or electric system breakdowns. Photovoltaic panel mounted with battery systems permit industrial buildings to continue to operate throughout power failures.

Simply Solar Illinois Can Be Fun For Everyone

Solar power is just one of the cleanest forms of energy. With long-lasting warranties and a production life of as much as try this web-site 40-50 years, solar investments contribute substantially to ecological sustainability. This change in the direction of cleaner power sources can visit cause broader economic benefits, including decreased climate modification and ecological deterioration expenses. In 2024, property owners can gain from federal solar tax obligation rewards, enabling them to balance out almost one-third of the purchase rate of a solar system via a 30% tax credit.

Report this page